Track single family investors and operators by portfolio size

Investors in the housing market vary based on factors like portfolio size, asset class, and business model. Segmenting investors by single family portfolio size helps us understand different investor behaviors, ranging from small mom-and-pop investors to large institutional portfolios.

The Portfolio Metrics endpoint category allows you to analyze investor activity by single-family home portfolio size (2-9, 10-99, 100-999, 1000+) across any U.S. market.

Data Coverage:

Category | Coverage |

|---|---|

Property Types | ✅ Single Family ❌ Townhouses ❌ Condos ❌ Other |

Markets (parcl_ids) | 🇺🇸 All US Markets |

Housing Events | ✅ Sales ✅ For Sale Listings ✅ Rentals |

Refresh Frequency | ✅ Weekly ✅ Monthly |

History | 📈 March 2024-Current |

Track institutional portfolio presence

Getting Started

Ways you can leverage endpoints today:

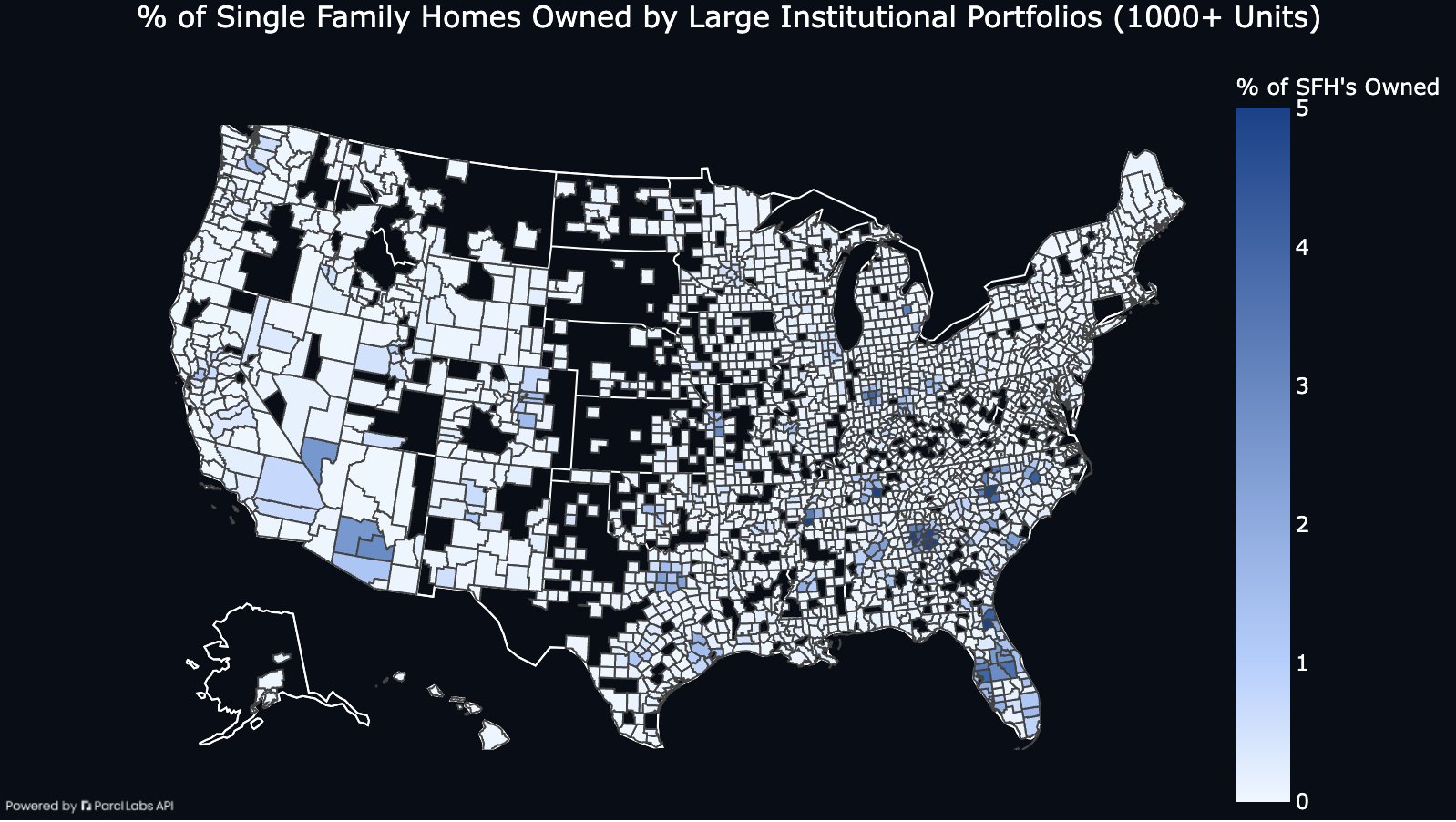

- Use the Single Family Housing Stock Ownership endpoint to determine the total number and percentage of properties owned by investors in a market, segmented by the size of their portfolios.

- Track the number of investor acquisitions, dispositions, new for sale listings, and new rental listings in a market, segmented by portfolio size, with the Housing Event Counts endpoint.

- Analyze weekly updated rolling counts of investor-owned properties newly listed for sale, categorized by portfolio size, with the New Listings For Sale Rolling Counts endpoint. This data provides a real-time signal of investor listing sources, indicating whether they are from small-scale or institutional investors.

- Examine weekly updated rolling counts of investor-owned single family properties newly listed for rent, categorized by portfolio size, with the Single Family For Rent Listings Rolling Counts endpoint. This data enables tracking of how investors of different portfolio sizes contribute to the on-market rental supply.

How Portfolio Size Segments Work

For the Portfolio Metrics endpoints, Parcl Labs uses an algorithm to determine the number of single family units an investor owns nationwide in the US. We exclude owner-occupied units from portfolio counts. It’s important to note that the portfolio sizes represent the number of units that owners within each segment possess across the US, not just within an individual Parcl ID.

Investors are then categorized into a portfolio size based on that count at a specific point in time:

- 2-9 Properties: Investors who own between two and nine single family homes. This segment typically includes individual or small-scale investors.

- 10-99 Properties: Investors managing between ten and ninety-nine single family homes.

- 100-999 Properties: Mid-sized investors that own between one hundred and nine hundred ninety-nine single family homes.

- 1000+ Properties: The largest scale of investors, including institutional investors and REITs, owning over a thousand single family homes.

- All Portfolios: This category combines all the above segments, providing a complete view of the single family home investment across the market.

Other Investor Analytics and Coming Soon

Parcl Labs tracks investors at three levels: as an overall cohort, by portfolio size, and at the specific housing owner or ‘entity’ level (e.g., Opendoor, Invitation Homes).

Available Now: Investor Analytics

If you want to examine broader investor trends across all property types, explore the Investor Metrics endpoints.

Available Now: True Entity Owner Data

Entity-level data enables users to analyze real-time activities and performance of Single Family Rental (SFR) operators like Progress, iBuyers like Opendoor, homebuilders like Lennar, and other influential entities in the U.S. housing market.

Entity-level data is now available via the property-level endpoints.

Coming Soon: Expanded History

Expanded history for portfolio metrics is on the roadmap.